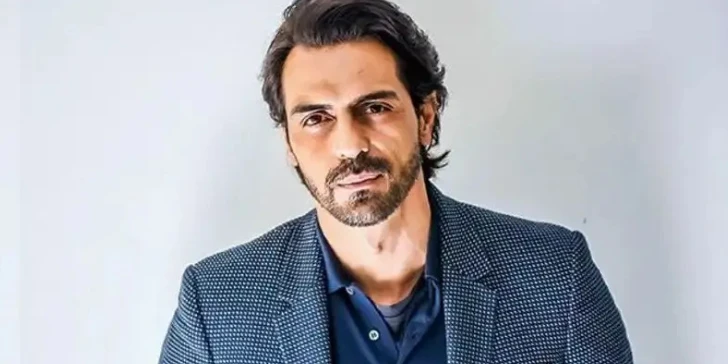

The Bombay High Court has set aside a magistrate’s order that issued a non-bailable warrant against actor Arjun Rampal in connection with a 2019 tax evasion case, describing the decision as "cryptic" and lacking judicial application of mind.

On May 16, Justice Advait Sethna of the Vacation Bench observed that the warrant, issued by a magistrate’s court on April 9, was “contrary to law” and passed without proper consideration of legal provisions.

Rampal had approached the High Court challenging the April 9 order, which stemmed from a complaint filed by the Income Tax Department under Section 276C(2) of the Income Tax Act. This provision deals with the willful attempt to evade payment of tax, interest, or penalty.

In his plea, Rampal said his lawyer had submitted an application seeking exemption from his personal appearance on the date in question. However, the magistrate rejected the request and proceeded to issue a non-bailable warrant without providing any reasons for doing so.

Justice Sethna noted that the offence Rampal is accused of carries a maximum sentence of three years and is a bailable offence. The magistrate failed to acknowledge this and issued the warrant in a “mechanical” manner, the High Court said. “In my view, it is a cryptic order which lacks application of mind,” Justice Sethna remarked.

The High Court further held that issuing a non-bailable warrant in a bailable offence causes undue prejudice to the accused, particularly when the actor’s advocate was present before the magistrate at the relevant time.

Rampal has also challenged an earlier order from December 2019 in which the magistrate’s court issued a notice to him in the same case. The High Court has listed the matter for further hearing on June 16.

Arguing on Rampal’s behalf, advocate Swapnil Ambure submitted that both the December 2019 and April 2025 orders were arbitrary. He stated that the full tax amount for the financial year 2016–17 had been paid, though belatedly, and denied any willful tax evasion as alleged by the Income Tax Department.

Ambure also contended that the issuance of the non-bailable warrant was inconsistent with Supreme Court rulings that caution against such measures in cases of this nature.

Website designed, developed and maintained by webexy